This article was originally published here in March 2002

All serious investors seek a system that returns consistently good profits. A good system should select shares that will perform in a predictable way in the future. People look for such a system in two different ways: Fundamental Analysis and Technical Analysis.

The traditional name for technical analysts is "chartists". The term came from their reliance on share price graphs. Today's technical analysts make use of the amazing number crunching power of modern computers and are less reliant on share price charts alone.

The premise of technical analysis is that share prices often move in predictable patterns. Once they have identified that a share is following a pattern they buy or sell short the share (short selling is a way of making a profit from a declining share price). One of the first proponents of technical analysis was an American called Charles Dow. In 1897 he created a stock market index of the leading companies. This formed the basis of today's Dow-Jones 30 Index. Dow used his index to track the performance of the stock market as a whole, something no one had attempted before. He developed a technical indicator, the "Dow Theory" that attempted to predict future performance of the market. The theory is too complex to explain here, but it is the ancestor of modern market analysis.  Before the advent of computerisation technical analysis was a tedious job. One had to create a graph of historical prices of a share and then draw on various trend lines by hand. We have a computer and the Internet to help us. Look at the share price chart on the right. You can see there was a sharp increase in price from September to November. It is possible to draw a line that roughly connects all the low points and another line that connects all the high points. It was a bad sign when the share price fell through the lower line in November and the price seems to have been in a falling trend since then.

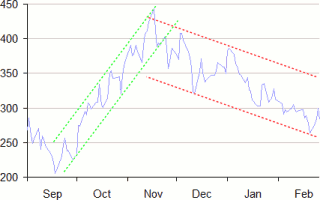

Before the advent of computerisation technical analysis was a tedious job. One had to create a graph of historical prices of a share and then draw on various trend lines by hand. We have a computer and the Internet to help us. Look at the share price chart on the right. You can see there was a sharp increase in price from September to November. It is possible to draw a line that roughly connects all the low points and another line that connects all the high points. It was a bad sign when the share price fell through the lower line in November and the price seems to have been in a falling trend since then.

The question that you must ask before committing any money to such an investment strategy is "Does it work?" In my experience the answer is a resounding "Maybe". I feel that technical analysis only works because enough people believe that it works. When an indicator gives a buy signal people purchase enough shares to cause a rise. For that reason technical analysis works better on the larger, more frequently traded shares.

Benjamin Graham can be regarded as the father of fundamental analysis. He taught a class on investing at Columbia University. With a colleague he published a book called "Security Analysis" in 1934 and published his own book "The Intelligent Investor

" in 1949. One of his pupils was Warren Buffett who is probably the most successful investor alive today.

The primary tool of a fundamental analyst is a company's annual report. Instead of comparing the current price of a share against historical prices as a technical analyst would, a fundamental analyst compares the current share price against what the annual report says the "true" value of the company is. If a fundamental analyst feels that the market is seriously undervaluing a company compared to his own valuation he buys some shares and waits for the market to come to its senses and prices the shares higher.

There are many styles of Fundamental Analysis. Some people prefer to look at the Balance Sheet. These people are known as "value" investors. One technique is to examine assets of a company. They add up the "good" assets (machinery, stocks, cash in the bank, money owed to the company, etc) and subtract the "bad" assets (money the company owes to its suppliers and money it has borrowed). Hopefully there are some good assets left after subtracting the bad ones. Dividing the current share price by the value of the remaining good assets gives the Price to Book ratio. If this ratio is less than one then they feel the company is seriously undervalued. Each pound spent buying a share in the company buys more than a pound of good assets.

Other fundamental analysts look at the Profit and Loss statement in the annual report. One technique of these "growth" investors is to predict future company earnings. From this they then try and predict what the share will be worth in the future. If the future price discounted by a reasonable rate of growth is less than the current price then the share is worth buying.

My personal investing style tends to the "value" side fundamental analysis although once in a while I buy into a good growth story. Next month I will take a look at some of my past trades to show the practical application of fundamental analysis.